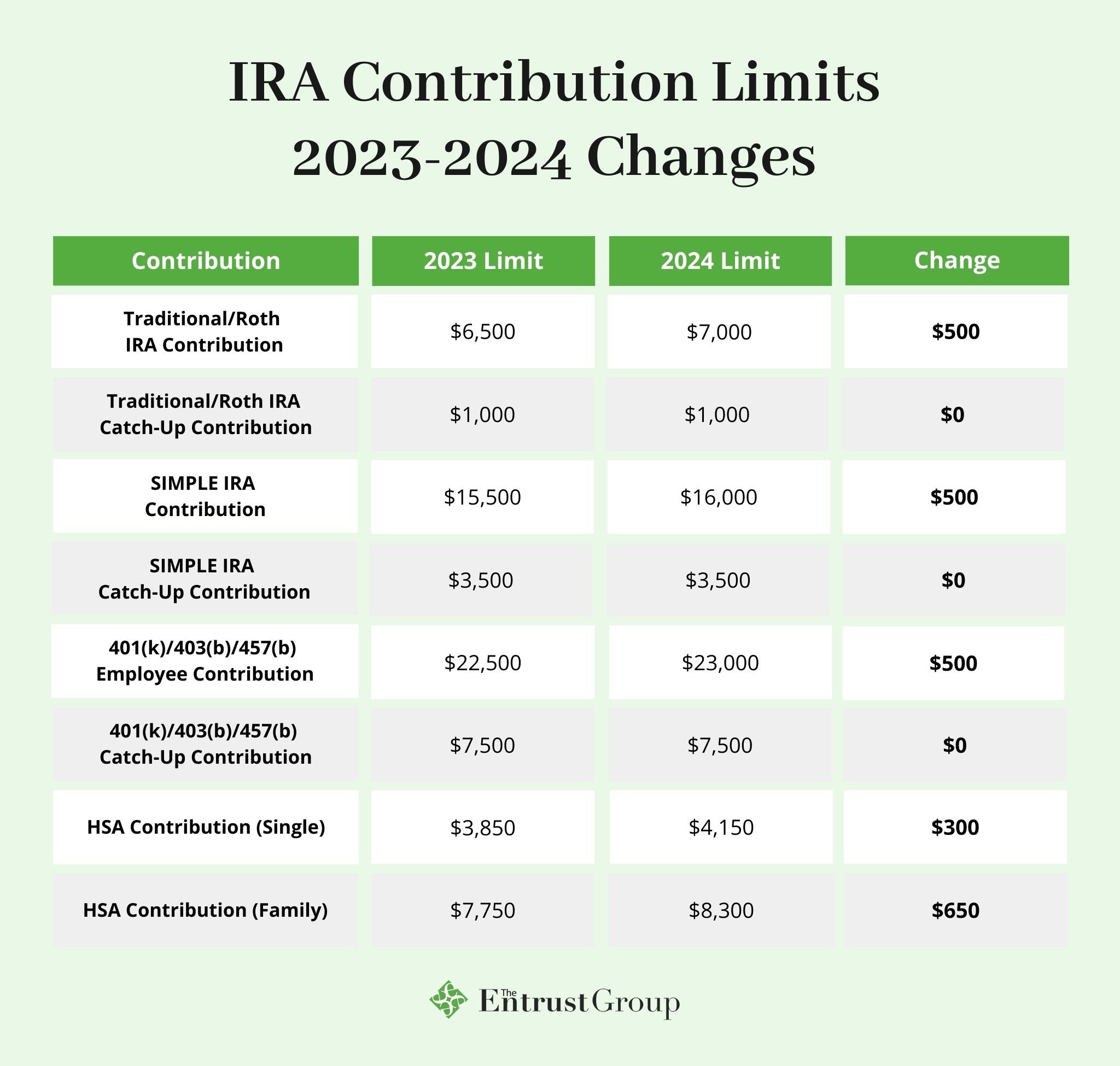

2024 Roth Ira Contribution Limits Chart – All-in-all, Roth IRAs offer certain people a great way to save for retirement, and this year, you can save even more. The IRS has increased contribution limits on IRAs for 2024, along with raising . Aaron is a freelance contributor to Newsweek. He has been credit card and travel rewards enthusiast since applying for his first credit card the day he turned 18. An avid deal-hunter, he leveraged .

2024 Roth Ira Contribution Limits Chart

Source : www.theentrustgroup.com

IRA Contribution Limits in 2024 Meld Financial

Source : meldfinancial.com

Everything You Need To Know About Roth IRAs

Source : www.aarp.org

Here’s the Latest 401k, IRA and Other Contribution Limits for 2024

Source : theneighborhoodfinanceguy.com

IRA Contribution Eligibility Flow Chart — Ascensus

Source : thelink.ascensus.com

The Best Order of Operations For Saving For Retirement

Source : thecollegeinvestor.com

Historical IRA Limit: Contribution Limit from 1974 to 2023 DQYDJ

Source : dqydj.com

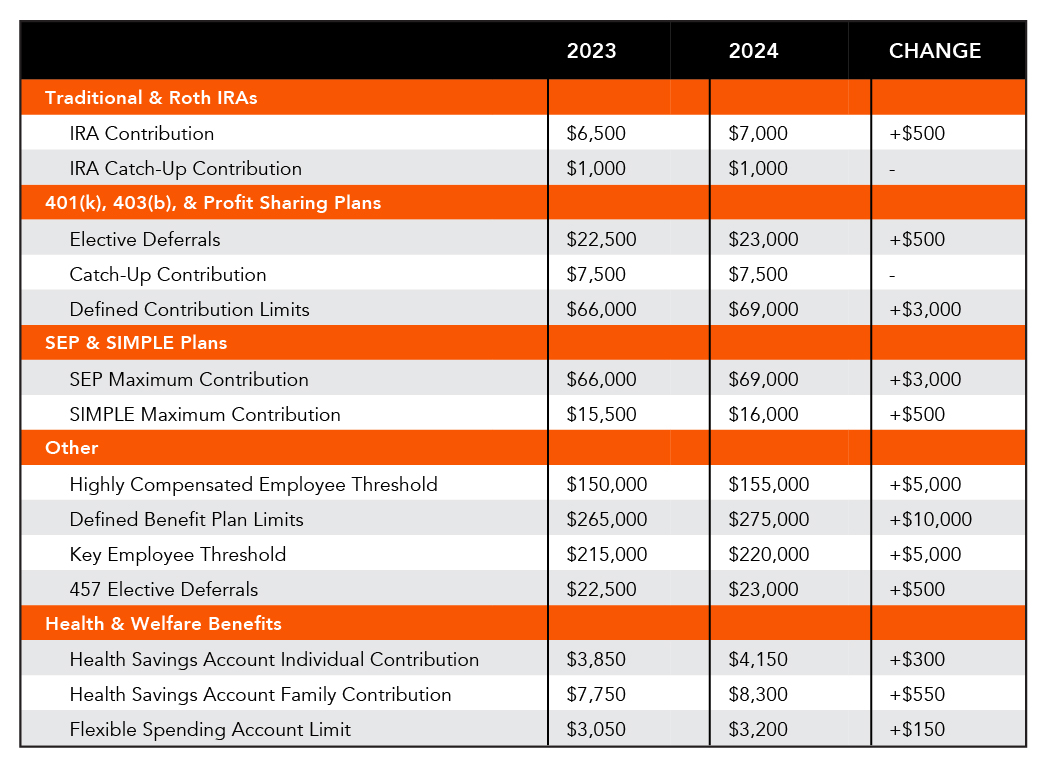

Plan Sponsor Update – 2024 Retirement & Employee Benefit Plan

Source : www.midlandsb.com

New 2024 IRS Retirement Plan Contribution Limits [Including 401(k

Source : www.whitecoatinvestor.com

Historical Roth IRA Contribution Limits Since The Beginning

Source : www.financialsamurai.com

2024 Roth Ira Contribution Limits Chart IRS Unveils Increased 2024 IRA Contribution Limits: Roth IRA income and contribution limits Like traditional IRAs, Roth IRA contributions for 2023 are limited to $6,500, or $7,500 if you’re 50 or over. If you have both types of IRAs, your total . The Roth IRA contribution limits in 2024 were raised to $7000, or $8000 for taxpayers 50 and older. How much you can contribute is limited by your income level, so it’s crucial to understand the IRS .